|

|

April 10, 2021

Dear Unitholder,

This has reference to your investment in Franklin India Ultra Short Bond Fund* (FIUBF), a scheme under winding up.

You are aware that the Hon’ble Supreme Court has appointed SBI Funds Management Pvt. Ltd. (SBI MF) as the liquidator for the schemes under winding up. The Hon'ble Court has also taken note of the Standard Operating Procedure (SOP) finalized by SBI MF in consultation with Franklin Templeton and SEBI to monetize assets of these schemes and distribute the proceeds to unitholders.

Further to the distribution of INR 5,075.39 crores in FIUBF in February 2021, we are pleased to inform you that SBI MF would be distributing the next tranche of INR 1,489.00 crores to unitholders. The latter will be paid by extinguishing proportionate units at the NAV dated 9 April 2021. Accordingly, the units held by you in the scheme will reduce to that extent. The payment to all investors whose accounts are KYC compliant with all details available will be made during the week of 12 April 2021. The amount to be paid to unitholders of FIUBF will be calculated as per the below table:

The amount payable to you will be 28.42% (as shown in the table above) of your portfolio value, prior to extinguishment of units, as of 9 April 2021. The same proportion (28.42%) of your units held will also be extinguished as per your respective plan level NAV as on 9 April 2021. The plan level NAVs are tabulated below :

(IDCW – Income Distribution cum Capital Withdrawal)

Here is an Illustration:

Scheme & Plan name: FIUBF-Retail Plan Growth Option

- As on 9 April 2021 and prior to extinguishment

- Portfolio value: INR 100,000 (A)

- NAV per unit: 28.0953 (B)

- Units prior to extinguishment: 3559.314 [100,000 / 28.0953] (C) = (A / B)

- Payout percentage: 28.42% (D)

- Payout amount: INR 28,420 (E) = (A x D)

- Units extinguished: 1011.557 (C x D) or (E / B)

Post this payout, FIUBF would have paid 68% of its AUM as on April 23, 2020.

The payment will be made electronically to all eligible unitholders by SBI MF. In case your bank account is not eligible for an electronic payment, a Demand Draft/Cheque will be issued and sent to your registered address by SBI MF. We will send an account statement to all unitholders showing details of units extinguished and payment made. However, if you hold units in your demat account, please contact your Depository Participant (DP) for your transaction statement. For your Capital Gains statement, you may reach out to us via our website, call centre or from your registered email ID and we will be happy to share the same with you.

Please note that the distribution for unitholders whose PAN/KYC, FATCA/UBO, Minor through guardian or Transmission details / documentation are not available/invalid, will be made after completion of the regulatory/ compliance requirements. We request unitholders to complete these formalities so that we can release the payment at the earliest.

Please write to us at service@franklintempleton.com or call our toll-free investor helplines 1-800-258-4255 or 1-800-425-4255 from 8 a.m. to 9 p.m. Monday to Saturday in case of any queries.

Sincerely,

Swaminathan Srinivasan

Head - Customer Services

Franklin Templeton Asset Management (India) Pvt. Ltd.

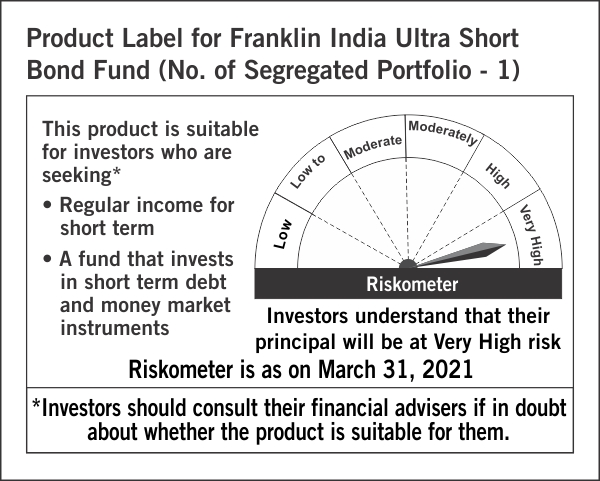

*Franklin India Ultra Short Bond Fund (Number of Segregated Portfolios - 1)

Disclaimer

The information contained in this communication is not a complete representation of every material fact and is for informational purposes only. Statements/ opinions/recommendations in this communication which contain words or phrases such as “will”, “expect”, “could”, “believe” and similar expressions or variations of such expressions are “forward – looking statements”. Actual results may differ materially from those suggested by the forward-looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risk, general economic and political conditions in India and other countries globally, which have an impact on the service and / or investments. The AMC, Trustee, their associates, officers, or employees or holding companies do not assure or guarantee any return of principle or assurance of income on investments in these schemes. Please read the Scheme Information Document carefully in its entirety prior to making an investment decision and visit our website http://www.franklintempletonindia.com for further details.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This email was sent by: Franklin Templeton Asset Management (India) Private Limited

Indiabulls Finance Center, Tower 2, 12th & 13th Floor, Senapati Bapat Marg, Elphinstone West, Mumbai, Maharashtra, 400013 INDIA

|

|